About Us

Overview

Kintbury Capital was founded in 2015. The firm runs a single strategy that is a low net pan-European Equity fund. The strategy combines long term fundamental bottom-up research with a philosophy of generating returns uncorrelated to equity markets. The strategy aims to deliver returns by generating alpha from both the long and short side of the portfolio, maximizing idiosyncratic single stock risk, rather than by making macro or factor bets.

The strategy looks to identify long positions with competitive advantage, high returns on capital employed, growing earnings and trading at attractive valuations based on proprietary valuation parameters. On the short side, companies are the inverse and often are struggling or have challenged business models often with an accounting angle. Kintbury Capital was founded by Chris Dale, our CIO. Prior to setting up Kintbury, Chris was a partner at Millennium Capital Partners in London from 2005 to 2014, where he ran the same strategy. The firm has 13 staff of whom 5 are partners.

About Us

Differentiators

Portfolio dominated by idiosyncratic stock risk

Fundamental investment process

Portfolio construction aimed at maximizing idiosyncratic stock risk and minimizing other risks.

25-35 longs with 2-3 year average holding period and 40-50 shorts with 1 year average holding period

Top 10 longs representing 50% of the long book and top 10 shorts 40% of the short book

Returns driven by alpha

Philosophically believe hedge funds should focus on alpha not beta.

Portfolio construction aimed at maximizing alpha and minimizing beta.

Uncorrelated returns

Uncorrelated returns profile vs the market

Uncorrelated returns profile vs other hedge funds

Strategy

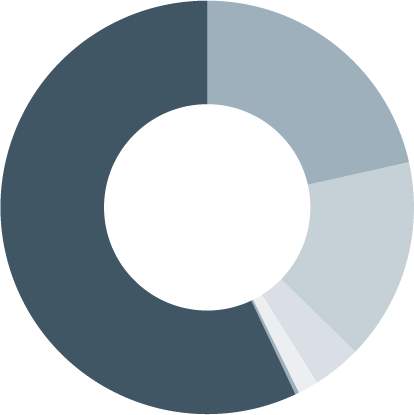

Dominated by non-factor stock risk

The strategy invests in companies in developed European equity markets with a market cap of over $3bn in order to maintain liquid positions in the fund. The strategy aims to combine fundamental long-term company analysis with a low net to the market and a pragmatic risk management approach. The investment philosophy of the firm is that the consensus is too focused on the short term and real value is generated in long term analysis. By minimizing the market exposure and with the stock picking process driven by micro rather than macro factors the returns should be driven by idiosyncratic single stock risk.

We are research driven at our core. Investments are generated from industry knowledge and a team who have specific sector coverage and core focus on Europe. The team meets over 300 companies a year and using their network within the sell-side, take 400 meetings a year to aim to improve industry knowledge and increase awareness of market positioning. Typical analysis involves understanding the prospects of a company and industry over a three-to-five-year period and our holding periods on both side of the book reflect this. Our five investment pillars are: valuation, fundamental analysis, ESG awareness, macro awareness and an accounting lens with a screening and implementation process proprietary to Kintbury. The accounting lens has been used on the long side but is mainly a tool on the short side and is highly alpha generative.

The portfolio will typically have up to 30-35 long and 45-50 short positions with a total gross exposure of on average just over 200% but with a maximum of 250%. The net exposure is up to +/-20% on a cash and beta adjusted basis but over time the returns are expected to be driven entirely by alpha generation on the long and short side of the portfolio rather than by beta exposure.

Carbon neutral business

Minimised plastic in office

Green energy supplier

Cycle to work scheme

ENVIRONMENTAL

Making the Leap

Supporting social mobility with an internship programme

Making the Leap is a London-based charity that works with partners nationwide to improve social mobility; by raising the aspirations of, and increasing opportunities for, young people between the ages of 11 and 30. Their mission is to transform the futures of disadvantaged young people in the UK by providing training to develop their skills, behaviours and attitudes to choose and succeed in a career.

Auditory Verbal UK (AVUK)

Support the Family Bursary fund to provide access for low-income families

AVUK’s vision is that every child born deaf can learn to listen and speak. We are the only charity delivering our specialist auditory verbal therapy (AVT) in the UK and each year we work with over 160 families of pre-school aged deaf children. We work in person from our centres in London and Oxfordshire and via online telepractice offering bursaries for families who would otherwise be unable to access our programme.

Cochlear Implanted Children’s Support Group (CICS)

CICS is a voluntary charity run by parents whose children have cochlear implants; offering contact, information, support, events and activity weekends for families whose children are too deaf to derive sufficient benefit from hearing aids. Childhood deafness can be an isolating experience for the whole family. Contact with others who have first-hand experience of living with cochlear implants in the family can be very reassuring and beneficial.

CHARITABLE PARTNERS

UN PRI signatory

Proprietary ESG analysis of all portfolio companies

MSCI ESG

On average longs have better ESG rating than shorts

These are all in addition to our fundamental due diligence

ESG INVESTMENT PROCESS

Analysis shows that Kintbury’s higher scoring ESG longs outperform other longs

Analysis shows that Kintbury’s higher scoring ESG shorts outperform other shorts

This is an addition to alpha added on both the long and short side.

ESG ATTRIBUTION

Carbon neutral business

Minimised plastic in office

Green energy supplier

Cycle to work scheme

Making the Leap

Supporting social mobility with an internship programme

Making the Leap is a London-based charity that works with partners nationwide to improve social mobility; by raising the aspirations of, and increasing opportunities for, young people between the ages of 11 and 30. Their mission is to transform the futures of disadvantaged young people in the UK by providing training to develop their skills, behaviours and attitudes to choose and succeed in a career.

Auditory Verbal UK (AVUK)

Support the Family Bursary fund to provide access for low-income families

AVUK’s vision is that every child born deaf can learn to listen and speak. We are the only charity delivering our specialist auditory verbal therapy (AVT) in the UK and each year we work with over 160 families of pre-school aged deaf children. We work in person from our centres in London and Oxfordshire and via online telepractice offering bursaries for families who would otherwise be unable to access our programme.

Cochlear Implanted Children’s Support Group (CICS)

CICS is a voluntary charity run by parents whose children have cochlear implants; offering contact, information, support, events and activity weekends for families whose children are too deaf to derive sufficient benefit from hearing aids. Childhood deafness can be an isolating experience for the whole family. Contact with others who have first-hand experience of living with cochlear implants in the family can be very reassuring and beneficial.

UN PRI signatory

Proprietary ESG analysis of all portfolio companies

MSCI ESG

On average longs have better ESG rating than shorts

These are all in addition to our fundamental due diligence

Download Our Approach to ESG guide

Analysis shows that Kintbury’s higher scoring ESG longs outperform other longs

Analysis shows that Kintbury’s higher scoring ESG shorts outperform other shorts

This is an addition to alpha added on both the long and short side.

Contact

Our Office

Kintbury Capital LLP

33 Cork Street,

London,

W1S 3NQ